Coronavirus, what have you done?

Jun 19, 2020

Martino Scheepens

The pandemic impacted the insurance industry in both predictable and unexpected ways. From the moment news of COVID-19 started spreading, insurance carriers knew there would be a significant business impact. Exactly what the impact would be was not immediately clear, and still leaves some room for guessing. Several months in, we can start to see how the pandemic has affected the industry and our customers.

What’s happening?

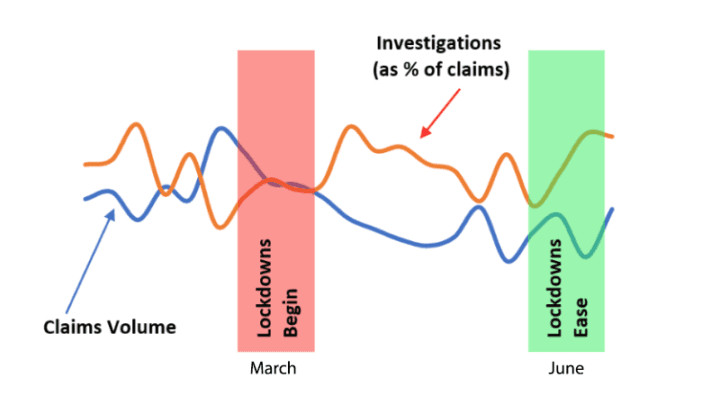

As FRISS supports carriers through all phases of the insurance lifecycle - from underwriting to claims and through the investigation process - we have deep insights into what’s happening across the globe. First, claims saw a sharp decline as the Coronavirus started hitting worldwide. For the most part, this came as no surprise. With fewer cars on the road, fewer accidents result in damage claims. There are fewer ways for people to hurt themselves if they never leave their homes. Workers' comp claims decline when the workplace is nearly empty. This was an anticipated and completely logical result. As the world started to come alive after 3 months and “life as normal” began to resume, claims volume started trending back toward normal. This regional trend was steady as municipalities loosened restrictions.

We also saw an expected correlation between claims volume and the number of cases being investigated. This curve followed closely as the number of claims fell. As re-opening began, we saw a sharp rise in suspicious cases. Investigation volumes are now on track to exceed normal volumes. Carriers are aware of the increased propensity for fraud during economic hardships, so part of this spike could be due to an increased focus on fraud prevention, with investigation units tasked to ramp up. It is also an unfortunate signal that claims fraud is on the rise. We’ve seen this before in economic downturns and other times of hardship, and sadly we predicted this at the onset of the pandemic. There are several reasons that fraud – or at least suspected fraud – is on the rise:

When faced with financial pressure, people will find any means necessary to get money

Insurance is misunderstood, and some feel they deserve something back after paying into the system for many years (the sudden need for money drives this thinking)

Carriers are laser-focused on customer satisfaction and may look the other way on issues that slow down claims payments (and many were forced to as they simply could not send exerts/investigators into the field)

Inflated COVID-related cleaning charges, fake testing locations and non-existent telemedicine visits are just a few of the emerging fraud schemes we are seeing. Unethical customers are aware of what they can get away with. They are also adept at coming up with new schemes - quickly. When the opportunity is available, it will be taken advantage of.

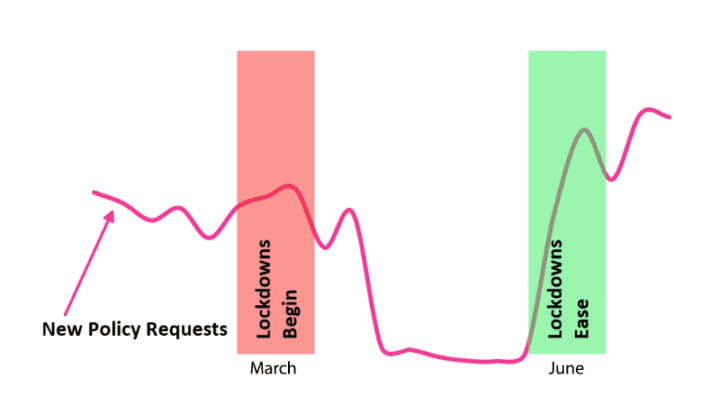

Lastly, our underwriting screenings give us a glimpse into customer behavior. New policy requests dropped almost 60%, flattening during the bulk of the pandemic shutdowns, suggesting consumers had more important things to worry about. Several weeks in, requests started increasing, surpassing normal volumes. This could indicate a few things:

Individuals want or need to save money and are looking for less expensive policies

Businesses owners may be frustrated with carriers who denied business interruption coverage

Carriers have invested heavily in advertising strong brand positions, causing customers to reconsider their existing relationships

What’s next?

If these insights tell us one thing, it’s that carriers who wish to weather the storm must remain diligent on treating their customers well. Policies must be easy to obtain at a competitive price, and claims handling must become more efficient and customer-centric. Modern carriers must adapt quickly and provide the service their customers demand.