How Munich Re Creates Added Value Through Automated Fraud Detection

Jun 4, 2019

Stefan Schroeter

As one of the leading reinsurers, we appreciate that our clients expect excellence from Munich Re. That is why we need to offer top class solutions in order to remain relevant to our customers.

Selecting the right partners

Partnerships are crucial to remaining relevant. This allows us to extend beyond our own reach and address bespoke needs for clients beyond our normal scope. While we provide many services directly through our internal expertise, we make use of external service providers for other services. To guarantee that our image and quality are not diminished, we will only cooperate with third party service providers if we consider them a reliable, long-term partner and when they are able to demonstrate a positive track record successfully implementing previous projects. At times, we may also consider cooperating with start-ups if they are able to convince us that they can deliver a clear added value to the value chain of our clients.

Whether we are working with a trusted third-party service provider or an up and coming start-up, we demand that there remains a close working relationship for each market and client approach and that we regularly exchange information about any and all activities regarding the services provided. This selection criteria ultimately comes down to ensuring our partners stick to the promises they made. Most importantly, working together with our clients in projects enables us to have more regular touch points with them and to understand their needs much better. Such projects also deepen our business relationship even further.

Added value means going beyond standard reinsurance offerings

As a premium reinsurer, we strive to offer our clients added value in addition to our traditional reinsurance capacity. That is why we think it is important to provide extra services beyond what our competitors may offer. This is a crucial way of establishing long-term client relationships. We want to understand the issues that our clients face along their process and value chain and to offer them solutions and services that will help them gain a competitive advantage that results in a positive economic impact.

FRISS is a perfect example of this relationship. In many Latin American markets, automated risk analysis and automated fraud detection still are in the early stages of development. With FRISS, we can offer our clients a sophisticated already existent digital solution for automated fraud detection to which they may not easily have had direct access to. In turn, this will improve their services to insureds, help to reduce overall costs and losses and make insurance more “honest.”

For a primary insurer, the added value of a FRISS software solution can facilitate long-term client relationships especially in regions that have not come fully on board with the automation of risk analysis and claim assessments. The FRISS tool can discover links that cannot be detected easily with the “human eye,” without spending too much time and money on it. This is possible because information from a large number of internal and external sources can be extracted when assessing the risk or legitimacy of the claim.

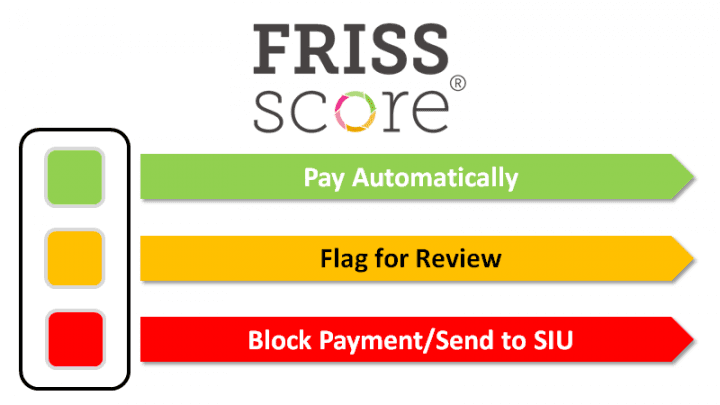

The automated assessment then generates a score. By automating the claim assessment process, including fraud detection, a “fast track” process can be created. In the case of a low or pre-defined score (which most claims usually are), no additional manual check is needed, and the claim can be paid out immediately. If the risk score exceeds a certain limit, further investigation is needed, and it may be an indication of a fraudulent claim.

Based on the information this generates, an underwriter can focus on clients with a complex insurance requirement and the fraud specialist can concentrate on the fraud investigation. Both the insured and the insurance company benefit from a claim that is paid out quickly. For the insurer, it is important to provide the best possible service to clients.

A deep business relationship is about providing what a client truly needs

Delivering this added value to our customers has different advantages for them and for us. Our goal is to offer the FRISS solution to our clients and to combine it with a reinsurance treaty. In proportional reinsurance treaties we benefit along with the clients from the reduced claims and costs through a higher technical underwriting result which enable us to offer more attractive reinsurance conditions to our clients in the end. We also have preferred terms and conditions agreed with FRISS and other service providers of which our clients can benefit when engaging in a business relationship with Munich Re.

Getting the most out of every regional insurance market

In many markets within Latin America the insurance penetration is still very low due to the lack of an “insurance culture.” In motor for example, only about 30% of all vehicles are insured. There is a high potential for more business. Other lines of business, such as liability, are often not yet fully explored and as advanced as in other markets. Often there is no awareness of insureds for certain exposures or these exposures do not yet exist due to a different claims and compensation culture. The economic development of a country also plays an important role in the need for insurance. The stronger the economy grows, the more the demand for insurance rises (e.g. the construction of major infrastructure projects like airports, dams etc.) combined with the desire to protect personal wealth.

We consider Latin America as a region with high potential to grow in insurance, reinsurance and new digital solutions. In Latin America, many insurance companies have started digital initiatives, of which some are already very advanced, and are looking for state of the art solutions. However, local experts with the respective know-how are not always available in every market. This is where we utilize our worldwide expert network to bring insights from other markets to new ones and, together with the local market know-how of each client, create new tailor-made service solutions.