Why Honest Insurance Benefits Us All

May 1, 2021

Marcy Koopmans

In most countries, as in the Netherlands where I happen to live, it is mandatory to be insured for healthcare and to have liability insurance for your vehicle in case you are responsible for someone else’s damage. Having insurance is considered a normal thing in life. And I believe it is a beautiful thing. I have a variety of things covered by insurance:

Home & Property

Legal

Travel

Life

Pets

My cats probably hate me when they go to the vet for a check-up. But I am happy how easy it is not having to pay any bills after they are treated or to worry about not being able to care for their treatment at all.

The Hidden Cost of Dishonest Behavior

Unfortunately, getting things “easily” taken care of by insurance, also attracts a more dishonest type of person: the fraudster.

Most people would never consider committing insurance fraud. But there are always a few bad apples. So, insurers set up robust processes to catch them. However, that often means that underwriters and claims adjusters have to go through each policy application or claim in much detail, treating everyone the same, fraudsters and honest citizens. This is because the price of fraud is high. The cost is high for the carrier because it hurts the bottom line. But more unfortunate is the price of higher premiums you and I pay on scammers behalf. The insurers that don’t have digitized and automated processes take a longer time to verify legitimate claims. We think that they don’t trust us and want to find ways not to pay our claim but in reality, they need to sift through each and every loss report manually! The insurers that automate trust and let AI handle bad apples, will also handle your claims faster.

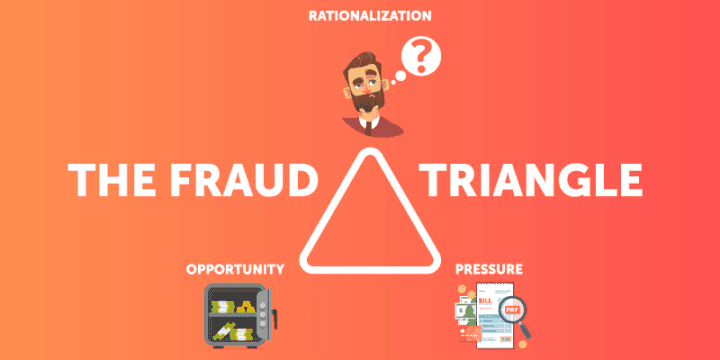

The Fraud Triangle

There is actually a logic as to why people commit fraud. The Fraud Triangle explains it from three angles: rationalization, pressure, and opportunity.

The fraudster makes excuses why he/she should commit fraud, the fraudster needs (or wants) the money, and the fraudster has the ability to commit the fraud.

Putting Theory into Practice

With the Fraud Triangle in mind, please let me introduce you to Bob. Bob has been saving money to buy a new car. So far, he saved about 40% for his dream car. However, saving money seems to take too long. He decides to take a risk and hopes gambling might double his cash… he was wrong. Bob then decided to change his luck and wrecks his current car, knowing it will cover at least his recent gambling misfortune. He drives the car to a quiet place and fakes an accident. After his perfectly executed plan, he decided to aim high and claim the total amount to buy his dream car. Here is where the fraud games begin! So, do you think what Bob did was a smart move? Since we all rely on insurance to live our best lives, there are three good reasons I’d say it wasn’t:

Insurance companies need to cover the costs of claims. That money needs to come from somewhere, and it comes from our insurance premiums.

Time spent investigating fraudulent claims could be better spent paying legitimate claims faster, turning honest customers’ moments of misery into moments of magic.

While you think you can get away with it, the consequences of getting caught are many: You may never qualify for needed insurance in the future, you could end up in jail and it could become quite embarrassing – the internet never forgets!

Don’t Be Like Bob

After an investigator looked into Bob’s case with the help of the SIU Trust Automation features , he noticed quickly that something was not right and Bob was trying to commit fraud. This happened in a matter of seconds, instead of days as it was before the insurer used the power of AI solutions. The insurer cancelled his policy and now Bob has a bill headed his way to cover the investigation costs, ouch! On top of that, he now has to search for another insurance company. Chances are that his fraudulent past will come up and they will reject him, double ouch! Bob becoming a failed Fraudster will now hunt him for many years to come

Make the World a Little More Honest

Insurance is all about trust. But without appropriate technology insurers have to work from a distrust mindset. Automating tedious processes allows insurers to focus on what benefits as all: Keeping your premiums low, focusing on fast payment of your claims, and taking genuine care of their customers. Be a superhero, support honest insurance!