How to Double the Output With the Same Number of staff

Customer

Tier 1 US Carrier

Challenge

Leverage the power of Big Data

Provide a streamlined underwriting flow

Improve internal efficiency & capacity for writing risks

Solution

FRISS Underwriting Insights

Customer

Our customer utilizes a unified system aligned around common underwriting, product and distribution strategies, which is what they call A Single View of Risk. This differentiated organizational principle allows the business to originate specialty risks, while responding with speed, capacity and innovative product solutions.

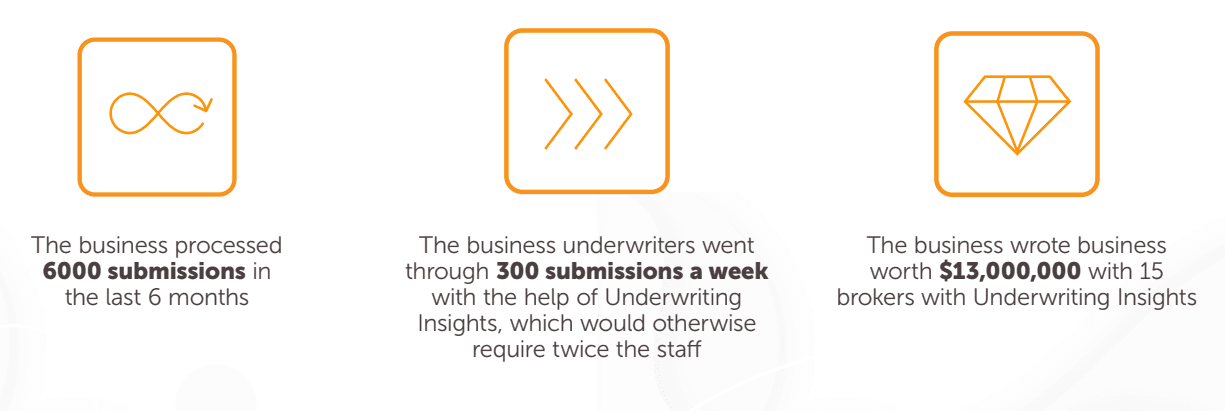

In this case study, we will look at how the leading global specialty insurance group leveraged the power of big data to provide a streamlined underwriting flow with the agents, and improved their internal efficiency with speed and capacity of writing risks. This has resulted in the business being able to scale their business model and write more business with greater confidence with a much smaller group of underwriters.

This leading carrier also has a unique approach to the carrier broker relationship, where they believe that mutual sharing of information brings value to both parties and fosters better business. The enrichment of the data set by Terrene’s Underwriting Insights on the insured, is shared with the broker in case the business decides to decline the risk

Challenge: Lost in Translation

Insurance companies rely heavily on brokers to supply information on clients, and it’s the underwriter’s job to validate the information and write the risks. Typically it’s the last step before the quote goes out to the client.

Many times the clients are not forthcoming with all the information to the brokers, while other times the brokers would fail to furnish all the information to the insurance carrier. More often than not, the information coming from the client to the broker and eventually to the insurance carrier goes through many versions or its essence is lost in translation.

Usually, the relationship between an insurance company and brokers is a one-way street, with brokers bringing insurance carriers the client information, and the insurance carrier would then assess the risk, and eventually decide whether or not to underwrite the risk and cover the client, and at what cost. The communication to the brokers traditionally is a yes/no response, with no further information being offered from the carrier.

The business’s philosophy is to share the information that was found during the process of underwriting with the brokers, thus building a collaborative relationship with them

Solution

Underwriting Insights uses decision science to manage multiple, disparate and growing Big Data sources, incorporates an understanding of the risk from structured and unstructured data content and provides a comprehensive risk profile.

This allows the business’s underwriting staff to focus on the core – Underwriting – and leave the chore – building the risk profile – to Underwriting Insights.